35+ Mortgage early repayment calculator

While the annual guarantee fee is 035 of the outstanding principal balance. Whether youre a first-time buyer home mover or youre remortgaging you can calculate your estimated monthly repayments with our mortgage repayment calculator.

Free 35 Loan Agreement Forms In Pdf

Marcus by Goldman Sachs.

. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. See how to use it. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

Mortgage Extra Repayment Calculator. Please note the calculator does not factor in any charges for early repayments of the total mortgage balance and is based on a capital repayment mortgage. With an interest only mortgage you are not actually paying off any of the loan.

All our bridging finance quotes are fully FCA Regulated 667602. With our switching mortgage calculator its easy to find out how much you could save. As of 2nd January 2015 Base Lending Rate BLR has been updated to Base Rate BR to reflect the recent changes made by Bank Negara Malaysia and subsequently by major local banks the interest rate on a BR.

The mortgage should be fully paid off by the end of the full mortgage term. Regarding purchases on or after 22 November 2017 special rules apply for first-time buyers and if the purchase price is 500000 or less. GDP data key.

Our bridging loan calculator gives a good indication of the expected rates and repayment costs when applying for a bridging loan. Aside from paying off the mortgage loan entirely typically there are three main strategies that can be used to repay a mortgage loan earlier. Payments per year - defaults to 12 to calculate.

Costs such as redraw fees or early repayment fees and costs savings such as fee waivers are not included in the comparison rate but may influence the cost of the loan. This overpayment calculator does not include all of the information that you need to select or compare mortgages. Try this free feature-rich mortgage calculator today.

For fixed rates the maximum monthly overpayment is 10 of the monthly mortgage repayment or 65 whichever is greater. 35 or even 40 years. A repayment mortgage means that over the length of the loan you will repay the full amount you borrowed as well as some interest.

Please request a Mortgage Illustration before you choose a mortgage. RBA takes cash rate to a near-eight year high 235 September 6 2022. It offers payment details and amortization tables with principal interest breakdowns.

The results are based on a repayment mortgage. Please note the calculator does not factor in any early repayment charges. This is because the interest on the debt will compound with most borrowers not making any repayments.

Mortgage rates tend to follow movements of the 10-year United States Treasury. Try this free feature-rich loan calculator today. This calculator assumes all variables remain constant for the duration of the loan.

Compare More Home Loans Compare More. Interest rates for housing loans in Malaysia are usually quoted as a percentage below the Base Rate BR. The Reserve Bank has increased the cash rate to 235.

Some lenders allow you to overpay up to a certain amount before. Calculate the cost of your home loan repayments using our loan repayment calculator to find out how much you can afford to borrow. Mortgage borrowers with a limited downpayment will likely be forced to pay for property mortgage insurance PMI.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Answer a few simple questions and in less than one minute well calculate the monthly and overall savings you could make by switching your mortgage to the best available rate available to you. With a capital and interest option you pay off the loan as well as the interest on it.

Find out if your lender is passing. To illustrate savings weve made the following assumptions. Best online personal loan providers.

Top online personal loan providers in the US market include. Extra payments reduce your principal balance faster which also shortens the loan term. It offers amortization charts extra payment options payment frequency adjustments and many other useful features.

For example if the current BR rate is 400 Update. The results displayed are based on the information you have entered. Worried homeowners on fixed rate mortgages with early repayment charges are being offered a new online calculator tool to help them decide if it is worth paying eye-watering exit fees to get a new.

At the end of the mortgage term the original loan will still need to be paid back. Stamp tax is not applicable for first-time buyers of properties worth 300000 or less and the existing rate. Our chattel mortgage repayment calculator can help you estimate your monthly repayments total interest as well as amount payable.

Mortgage repayment calculator. Home Real Estate Mortgage Repayment Calculator. However rates can change which means the actual impact of a mortgage overpayment cannot be guaranteed.

35 or even 40 years. Our calculator can factor in monthly annual or one-time extra payments. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage.

Payments per year - defaults to 12 to calculate the monthly loan payment which amortizes over the specified period of years. 06 Sep 2022. The current average lifetime mortgage rate is 425 compared to 275 for standard residential mortgages.

An interest-only mortgage means you only pay the interest and once the loan is over eg 25 years after you took it. The interest rate will remain the same for the term of the mortgage. Construction loans explained Paying off your mortgage early.

Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment. The annual fee is also paid for the entire loan term. This has the most impact during the early years of the loan.

Monthly Capital Interest Payment Breakdown. In some cases it may drain almost all the value of your home with little left over for your heirs. Get the best bridging loan rates in the UK starting from 039.

Take note of early repayment charges ERC. However borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

If you would like to pay twice monthly enter 24 or if.

Best Reverse Mortgage Services In Arizona Sun American

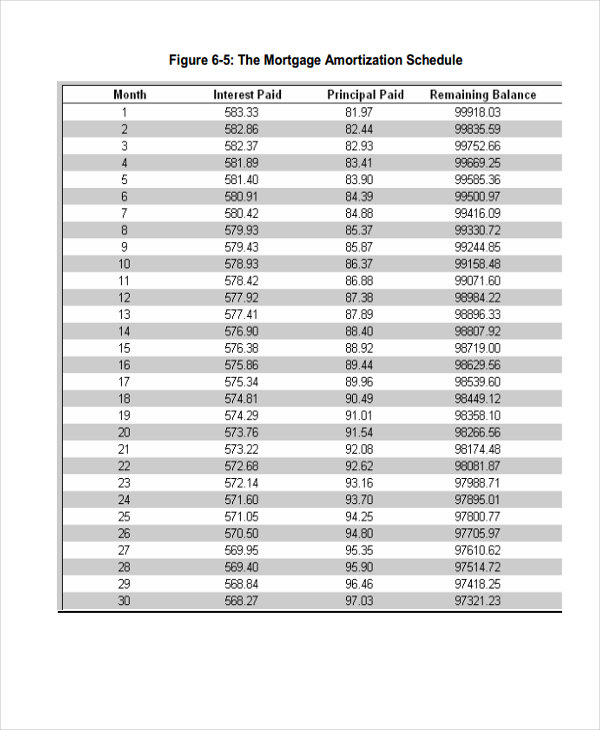

29 Amortization Schedule Templates Free Premium Templates

Lbc Mortgage Solutions Google Mortgage Rates Fixed Rate Mortgage Refinance Mortgage

Pin On Album Book Journal

Best Home Loans Mortgage Lenders Company Arizona Utah

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Refinance Mortgage Lenders Az Sun American Mortgage

Access Of Louisiana Federal Credit Union Can Help You Get The Car Loan You Need Today Find Out More Inform Car Loans Bad Credit Car Loan Personal Loans Online

Best Home Loans Mortgage Lenders Company Arizona Utah

Do You Want To Work From Anywhere You Can In 3 Easy Steps Job Employment Job Seeker

Additional Mortgage Payment Savings Infographic Househunt Real Estate Blog Mortgage Payment Savings Infographic Mortgage Info

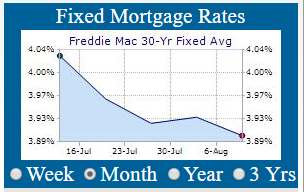

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Mortgage Calculator Texas Home Mortgage Loan Calculator

10 Video Personalization Ideas To Increase Mortgage Leads

Adjustable Rate Mortgage What Is It And How Does It Work

How To Save Money With Your Boyfriend Random Assets Of Life Saving Money Couple Finances Financial Planning Dave Ramsey

Pin On Hometalk Summer Inspiration